They offer users maximum comfort when making card payments. Strive to give your customers more and enable them to leave wallets at home, since the mobile card payment service features all cards in one place, always at hand. At the same time you enable them fast and simple contactless payments.

Service and advantages

By introducing support to mobile payments, Bankart wishes to support banks in the introduction of new, modern payment methods which do not necessarily result from obligations and regulations. This solution will bring value added to the introduction of modern banking services, which in the long run contribute to the recognition of the banking system as a technologically advanced system, while at the same time NFC technology does not require any upgrades on the merchant side. Each POS terminal that can accept a wireless card can also accept the NFC mobile device. The majority of the POS network processed by Bankart has already been upgraded by contactless readers, and is therefore also prepared for NFC mobile payments. By 2020 at the latest, all POS terminals will have to be upgraded, both in the Bankart network and elsewhere due to the mandates of payment schemes. Payment schemes have also prepared the specifications providing standardised frameworks for the implementation of new mobile solutions, so that it is possible to ensure full compliance with the EMV and PCI DSS standards.

The introduction of the mobile card payment solution is cost-effective because it deploys the tokenisation services already established by card schemes instead of internal tokenisation.

Regardless of the use of external tokenisation, the solution offers a large set of functionalities for MasterCard and Visa card products.

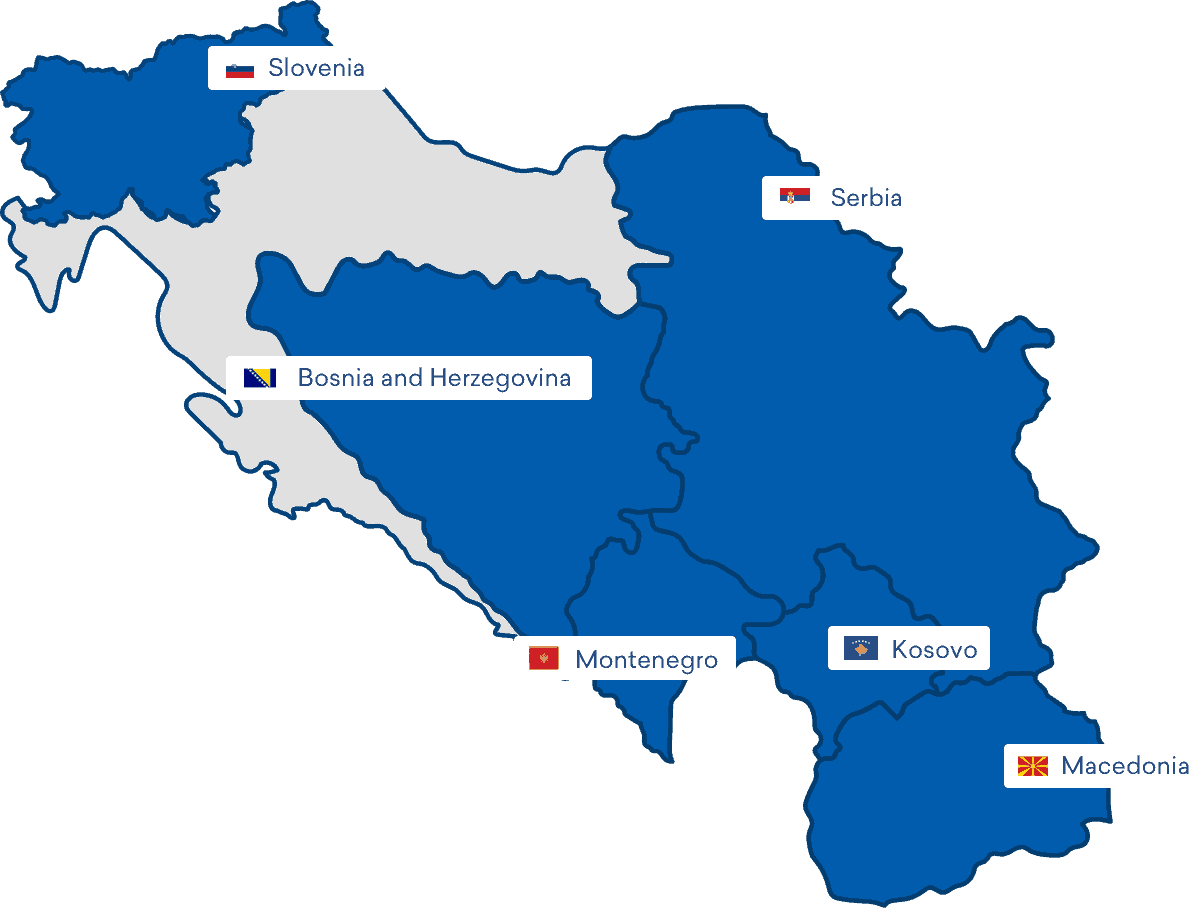

The solution consists of two basic building blocks:

- The infrastructure part which allows for the connectivity with the card schemes, together with the back-office platform, the NFC module and other infrastructure components common to all banks using the service with the aim of maximising the cost effectiveness.

- The individual part comprises additional modules in the mobile application and the back-office systems which the banks can adapt to their needs. Banks are therefore given the opportunity of form differentiation and of different functionalities for their clients, thus providing a unique user experience.

The basic functionalities of the Mobile card payment service

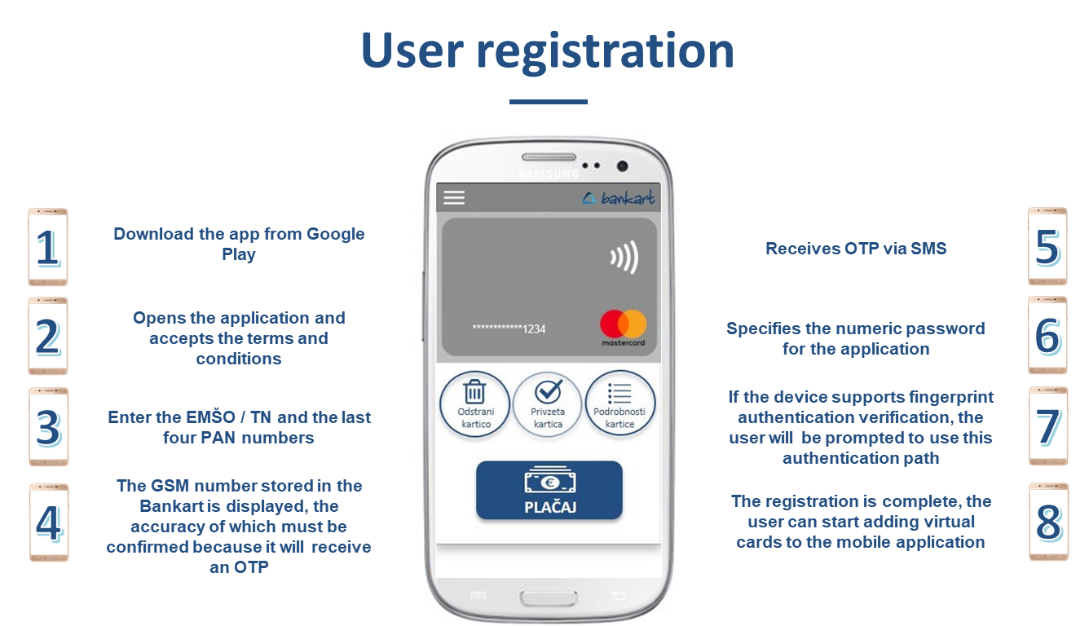

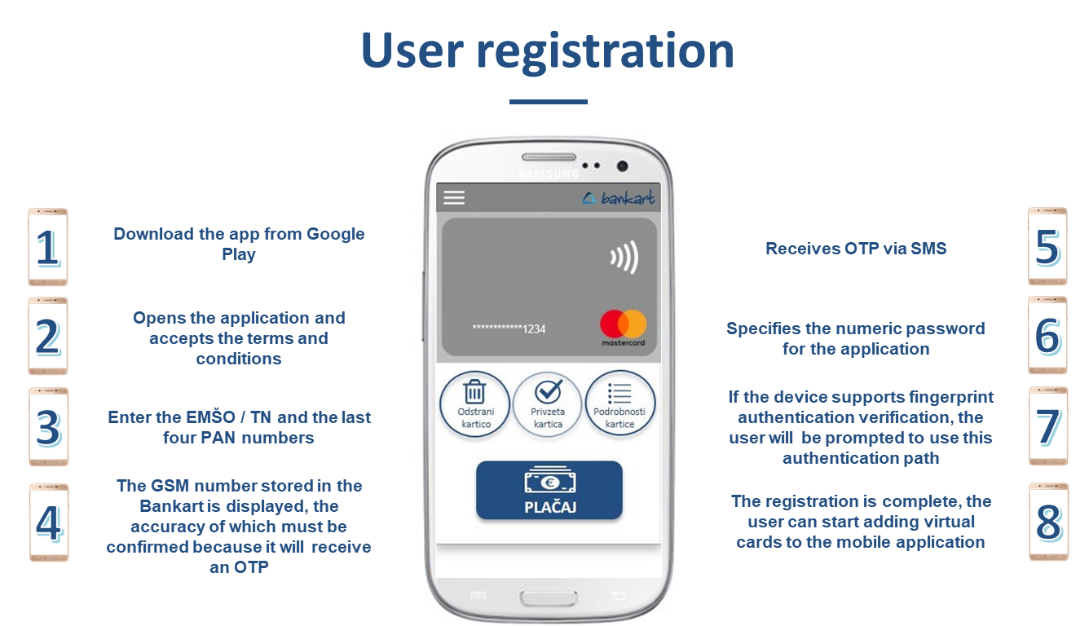

- User registration

- Adding (and removing) virtual cards

- Payment at contactless POS terminals

- Overview of the history of transactions

- Determining the default virtual card for payments

- Change of mobile PIN

- Overview of the general information on individual virtual cards

The mobile payment platform enables different degrees of integration with the bank systems. Banks are able to choose among models minimising the impact on the existing systems (use of the existing channels for card management) and models with a higher degree of integration enabling the bank greater control over new services.

User experience

Simple user registration

Simple and secure payment

- The payment approach is the same as when paying with a card, which means that for high-value payments (over EUR 15) you will need to enter a PIN at the POS terminal.

- To make the payment, the user will have to unlock the screen. Payments will not be possible with locked devices.

- Another option is for the user to open a mobile application and pay from homepage.

Possibilities of further development – Digitalisation platform

The mobile application will further represent the basis for the new mobile platform where, in addition to contactless payment, we will also be able to offer banks many other mobile services for card holders. Specifically, it is possible to introduce functionalities such as:

- Next generation of internet card payment (secure internet payment without the entry of the card number – MasterPass, Visa Checkout, in-app payments, etc.).

- Instant payments.

- A new channel for communication between the bank and the holder in real time (opportunity for loyalty and marketing activities).

Management of physical cards (blocking, unblocking, limits, SRM codes and other security settings, etc.).